What You Need To Know About The Tax Cuts And Jobs Act Of 2017

The Tax Cuts And Jobs Act of 2017

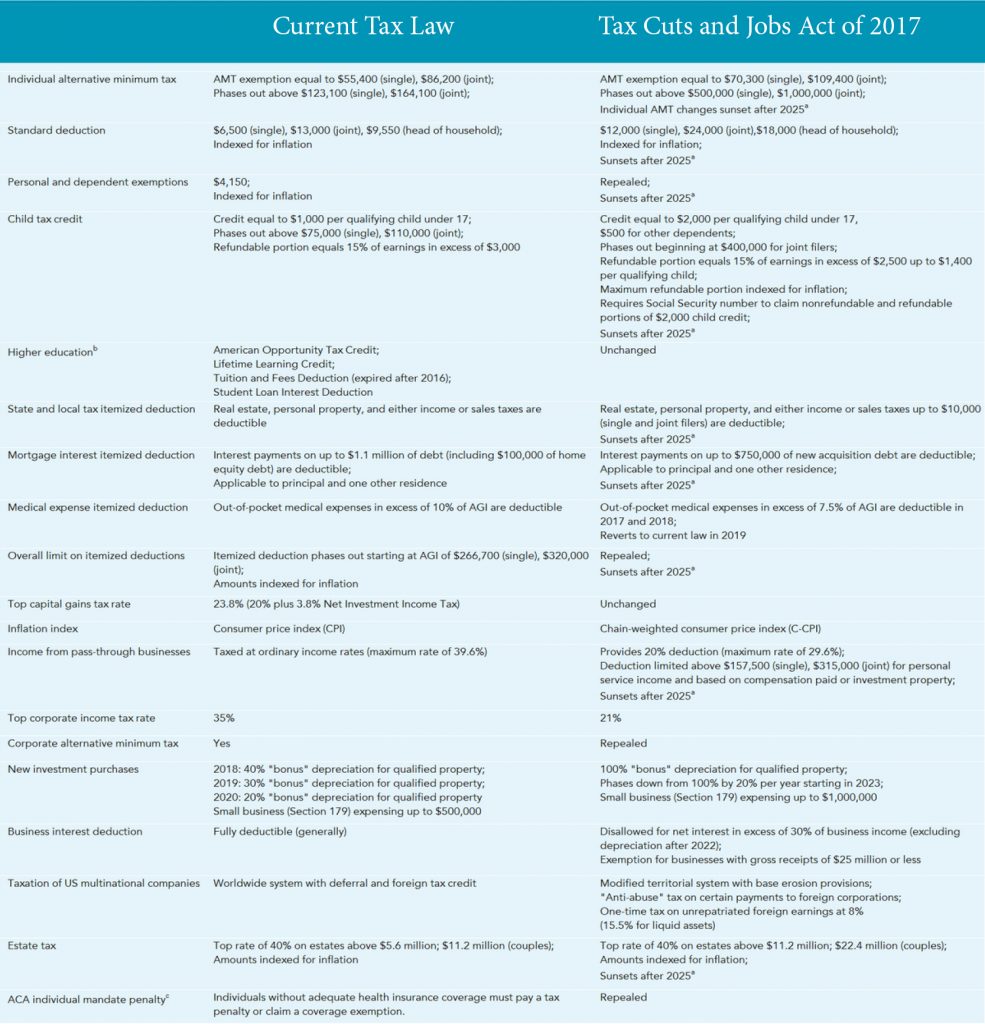

As you are most likely aware, The Tax Cuts And Jobs Act of 2017 was signed into law today, December 22nd, 2017 by the President. Here’s what you need to know, as individual taxpayers as well as businesses. Of course, if you have any questions, please do not hesitate to contact us!

Here are some moves to consider before the end of 2017

Prepay your 2018 property taxes, if possible.

Taxpayers who itemize their deductions may want to consider prepaying their 2018 property taxes before December 31st. Because the Tax Cuts And Jobs Act of 2017 will cap the deduction for state and local taxes (SALT) at $10,000 starting next year, homeowners in high-tax regions like New York and New Jersey can maximize their SALT deductions in 2017. Homeowners who bank to escrow the funds are not eligible, however.

Make bigger charitable donations

The GOP tax bill almost doubles the standard deduction to $12,000 for single people and $24,000 for married couples. That means taxpayers whose deductions fall below those caps won’t be able to itemize in 2018. Because of that, taxpayers may want to consider contributing more to charity in 2017 while they’re more likely to be able to itemize their deductions. The value of those deductions will be greater this year compared with 2018 when many taxpayers will be pushed into a lower tax bracket under the new GOP provisions.

Defer income until 2018

Many taxpayers will find themselves in a lower tax bracket next year under the GOP provisions. For instance, married couples who earn a combined income of $80,000 will be in a 22 percent tax bracket next year, compared with the 25% under the current law. That creates an incentive to defer income until next year, when tax rates may be lower. Of course, that’s not possible for those Americans who receive a paycheck every two weeks from their employers. But workers who expect year-end bonuses could talk with their employers about delaying payment until 2018. Likewise, contractors can ask clients to delay payment until after January 1, and small business owners can consider pushing their own income payouts into the new year.

New Tax Brackets under the Tax Cuts And Jobs Act of 2017

MARRIED INDIVIDUALS FILING JOINT RETURNS AND SURVIVING SPOUSES.

| “If taxable income is: | The tax is: |

| Not over $19,050 | 10% of taxable income. |

| Over $19,050 but not over $77,400 | $1,905, plus 12% of the excess over $19,050. |

| Over $77,400 but not over $165,000 | $8,907, plus 22% of the excess over $77,400. |

| Over $165,000 but not over $315,000 | $28,179, plus 24% of the excess over $165,000. |

| Over $315,000 but not over $400,000 | $64,179, plus 32% of the excess over $315,000. |

| Over $400,000 but not over $600,000 | $91,379, plus 35% of the excess over $400,000. |

| Over $600,000 | $161,379, plus 37% of the excess over $600,000. |

HEADS OF HOUSEHOLDS.

| “If taxable income is: | The tax is: |

| Not over $13,600 | 10% of taxable income. |

| Over $13,600 but not over $51,800 | $1,360, plus 12% of the excess over $13,600. |

| Over $51,800 but not over $82,500 | $5,944, plus 22% of the excess over $51,800. |

| Over $82,500 but not over $157,500 | $12,698, plus 24% of the excess over $82,500. |

| Over $157,500 but not over $200,000 | $30,698, plus 32% of the excess over $157,500. |

| Over $200,000 but not over $500,000 | $44,298, plus 35% of the excess over $200,000. |

| Over $500,000 | $149,298, plus 37% of the excess over $500,000. |

UNMARRIED INDIVIDUALS OTHER THAN SURVIVING SPOUSES AND HEADS OF HOUSEHOLDS.

| “If taxable income is: | The tax is: |

| Not over $9,525 | 10% of taxable income. |

| Over $9,525 but not over $38,700 | $952.50, plus 12% of the excess over $9,525. |

| Over $38,700 but not over $82,500 | $4,453.50, plus 22% of the excess over $38,700. |

| Over $82,500 but not over $157,500 | $14,089.50, plus 24% of the excess over $82,500. |

| Over $157,500 but not over $200,000 | $32,089.50, plus 32% of the excess over $157,500. |

| Over $200,000 but not over $500,000 | $45,689.50, plus 35% of the excess over $200,000. |

| Over $500,000 | $150,689.50, plus 37% of the excess over $500,000. |

MARRIED INDIVIDUALS FILING SEPARATE RETURNS.

| “If taxable income is: | The tax is: |

| Not over $9,525 | 10% of taxable income. |

| Over $9,525 but not over $38,700 | $952.50, plus 12% of the excess over $9,525. |

| Over $38,700 but not over $82,500 | $4,453.50, plus 22% of the excess over $38,700. |

| Over $82,500 but not over $157,500 | $14,089.50, plus 24% of the excess over $82,500. |

| Over $157,500 but not over $200,000 | $32,089.50, plus 32% of the excess over $157,500. |

| Over $200,000 but not over $300,000 | $45,689.50, plus 35% of the excess over $200,000. |

| Over $300,000 | $80,689.50, plus 37% of the excess over $300,000. |

ESTATES AND TRUSTS.

| “If taxable income is: | The tax is: |

| Not over $2,550 | 10% of taxable income. |

| Over $2,550 but not over $9,150 | $255, plus 24% of the excess over $2,550. |

| Over $9,150 but not over $12,500 | $1,839, plus 35% of the excess over $9,150. |

| Over $12,500 | $3,011.50, plus 37% of the excess over $12,500. |

Source: http://www.taxpolicycenter.org/feature/analysis-tax-cuts-and-jobs-act

To read the new tax bill in its entirety, visit:

https://www.congress.gov/bill/115th-congress/house-bill/1